The IRS considers cryptocurrency to be property, so any sales result in either capital gains or losses for sales to buyers of cash or services such as goods and services.

Taxpayers must maintain detailed transaction logs and substantiate valuations to reduce the risk of an IRS audit. When using multiple cryptocurrency exchanges for transactions, taxpayers should use consistent methods when assigning values if possible to reduce an audit risk.

Capital Gains and Losses

As cryptocurrency’s value fluctuates, you should remain cognizant of how that volatility might impact your business taxes. According to IRS rules, cryptocurrency should be treated like any property; any time you sell or exchange crypto for non-crypto assets or use it to pay for goods or services may trigger a reportable event and warrant tax reporting.

When selling or trading cryptocurrency for a profit, capital gains tax must be recognized and paid; similarly when disposing of cryptocurrency at a loss.

Mining cryptocurrency is another taxable event, and you may be eligible for deductions based on whether it’s done for personal or business reasons and the type of coin mined. Please consult a tax professional if this activity falls under your purview.

Depreciation

When selling cryptocurrency, the IRS treats it like any other asset; therefore, when selling, tax will be due on any difference between its original purchase price (known as its cost basis) and the selling price.

Costs associated with starting and operating a business can be steep, so it’s wise to deduct as many expenses as possible from taxes through depreciation.

Most small businesses utilizing the MACRS method use it, which allows you to take a larger deduction in early years and a smaller deduction later. However, if you use cryptocurrency to buy equipment or materials you may need to report these transactions as capital gains as their values fluctuate significantly and it is difficult to establish their fair market value in fiat currency. Merchant services companies like BitPay help protect your business against such volatility by instantly exchanging digital currencies for cash in real time.

Foreign Transactions

Americans who own foreign-based small businesses are already subject to reporting requirements such as FBAR and FATCA, with reporting requirements such as FBAR and FATCA being implemented since 2017. Starting this year, a transition tax went into effect that levies a 15.5 percent tax on cash and cash equivalents held by controlled foreign corporations and an 8 percent tax on any other earnings held by controlled foreign corporations; such a transaction tax might encourage currency speculators to shift trading into more liquid forms such as Treasury bills, swaps in commodity markets or futures contracts instead.

Taxes

Tax regulations surrounding cryptocurrency vary considerably by country. As a general guideline, though, the IRS treats crypto as property and taxes it like any other capital asset.

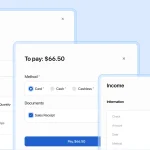

When selling cryptocurrency, its sale price represents your taxable gain (or loss) in fiat currency. To reduce tax burden and save time when filing taxes, keep track of each cryptocurrency you own’s original purchase price as its cost basis – an invaluable way to stay tax efficient!

Capital gains tax must also be paid when exchanging cryptocurrency for another type, or using it to purchase something else. When this occurs, you must notify the IRS as well as record your new purchase price (also referred to as fair market value) of each cryptocurrency you own.

Small businesses may find that accepting cryptocurrency helps them save money on transaction fees charged by credit card processing companies; these fees typically account for more than one percent of total sales for smaller stores.