Let’s be honest—taxes and sustainability aren’t topics that usually spark joy. But what if your efforts to...

Tax

Let’s be honest. When you’re building a brand, editing a viral video, or finally minting that NFT...

Let’s be honest. Estate planning used to feel… tangible. You’d gather the paperwork for the house, the...

Let’s be honest. When you’re building a startup, tax planning is probably the last thing on your...

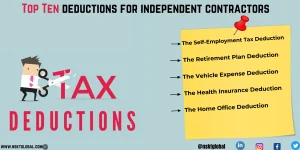

So, you’ve cut the cord. Your office is now your living room, a coffee shop, or maybe...

Let’s be honest. After a long shift—whether you’re charting patient notes or debriefing after a critical call—the...

Let’s be honest. When most people think of estate planning, they picture houses, bank accounts, and maybe...

Let’s be honest. Planning for the long-term financial security of a loved one with a disability is...

So, you’ve cut the cord. Your office is wherever your laptop opens, be it a beachside cafe,...

Let’s be honest. When you started creating content, selling digital products, or trading NFTs, you probably weren’t...