In the dynamic world of financial markets, traders have a range of instruments at their disposal to pursue opportunities and manage risk. One such instrument that has gained considerable attention over recent decades is the contract for difference, commonly known as a CFD. For many market participants, CFDs present a flexible way to engage with price movements across asset classes without the obligations and costs associated with owning the underlying asset itself. Understanding how these contracts work and why they appeal to both novice and experienced traders is essential for anyone looking to deepen their involvement in financial markets.

In this post, we will explore the mechanics of CFDs, how they allow traders to speculate on price movements, and what considerations are important when using them. Throughout, the goal is to demystify the concept and offer insight into how CFDs function in practice.

Understanding the Basics of CFDs

At its core, a contract for difference is a derivative product. Derivatives are financial instruments whose value is derived from the price of another asset. In the case of a CFD, the underlying asset might be a stock, index, commodity, currency pair, or other financial instrument.

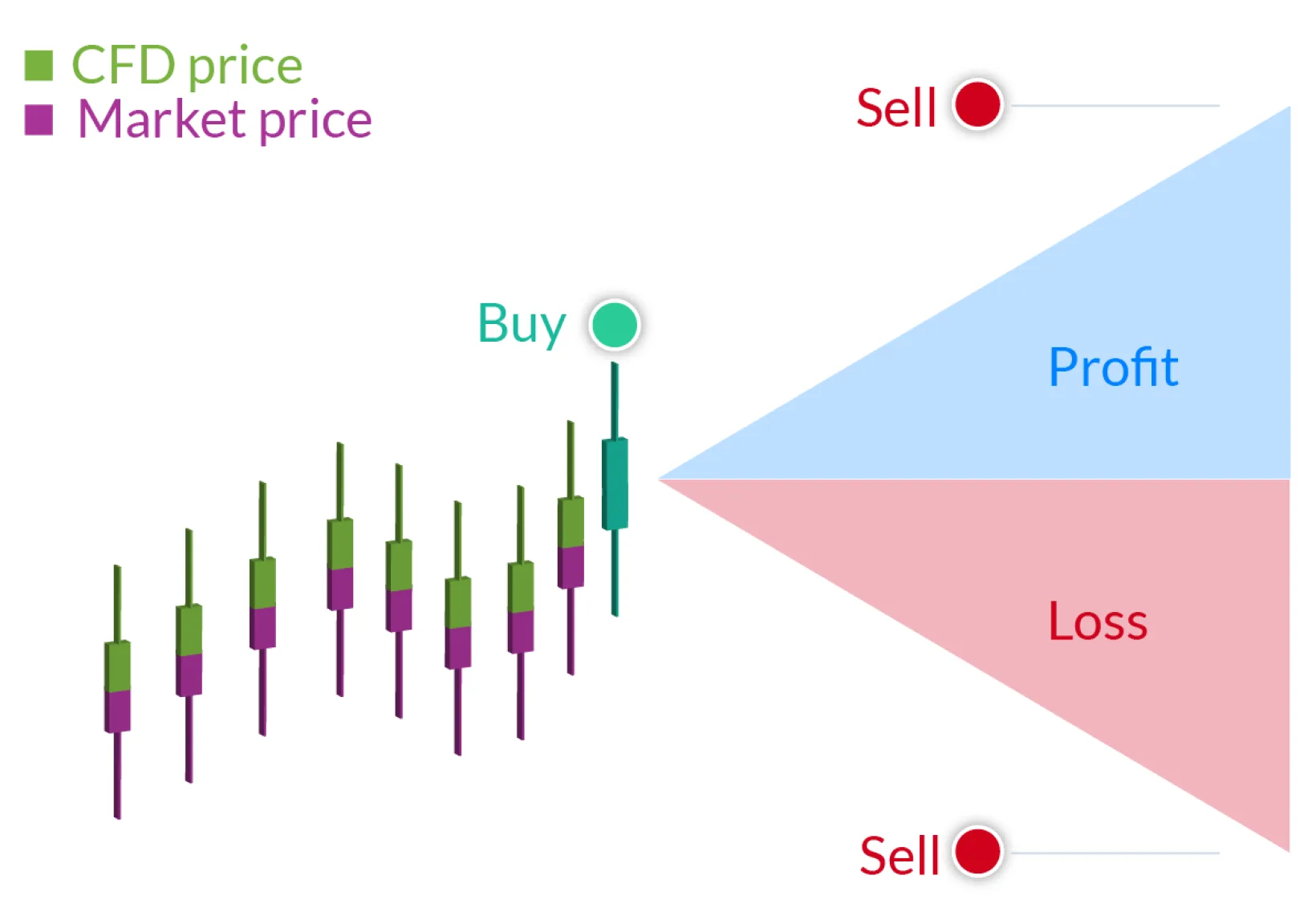

When a trader enters into a CFD position, they are agreeing to exchange the difference in the value of the underlying asset from the moment the contract is opened to when it is closed. If the price moves in the trader’s favour, the broker pays the difference. If the price moves against the trader, the trader pays the difference.

This mechanism allows traders to participate in market movements without ever taking ownership of the actual asset. For example, a trader can speculate on the price of gold rising or falling without buying physical gold or gold futures. If you are curious about the specific mechanics of these instruments, a good resource on CFD how it works offers a clear explanation and practical examples that can help you visualise the process.

The Appeal of CFD Trading

CFDs have become popular for several reasons, chief among them their flexibility and accessibility. Unlike traditional trading, where purchasing stocks or commodities often requires significant capital, CFDs typically allow for a smaller initial outlay through the use of margin. Margin trading means that the trader only needs to deposit a fraction of the total value of the position, known as the margin requirement, to open a trade.

This leverage can amplify gains, which is appealing to traders who want to make the most of favourable price movements. However, it is important to understand that leverage also increases risk. Just as profits can be multiplied, so too can losses.

Another aspect of CFDs that makes them attractive is the ability to profit from both rising and falling markets. This is achieved through “going long” or “going short.” When a trader goes long, they are speculating that the price of the underlying asset will rise. Conversely, when a trader goes short, they are speculating that the price will fall. This dual capability provides a strategic edge in volatile markets where price swings in either direction can present opportunities.

How Traders Use CFDs Strategically

Successful trading with CFDs begins with a solid understanding of market analysis and risk management principles. There is no single “best” strategy, but there are common approaches that many experienced traders incorporate into their trading frameworks.

Technical analysis is widely used in CFD trading. This involves studying price charts and patterns to identify potential entry and exit points. Indicators such as moving averages, relative strength index (RSI), and support and resistance levels can help traders make informed decisions based on historical price behaviour.

Fundamental analysis, on the other hand, focuses on economic and financial factors that may influence an asset’s price. For example, interest rate decisions, corporate earnings reports, and geopolitical events can all have significant impacts on market sentiment and price direction. CFD traders often combine both technical and fundamental analysis to build a comprehensive view of market conditions.

Considerations and Risks

While the benefits of CFD trading are clear, it is important to appreciate the risks involved. As derivatives, CFDs do not confer ownership rights in the underlying asset. This means traders do not receive dividends from stocks or physical delivery of commodities. The value and costs associated with CFD positions are tied purely to price movements.

Leverage, as mentioned earlier, can magnify losses as well as gains. In extreme market conditions, losses can exceed the initial margin. For this reason, many traders set strict risk limits and use tools such as negative balance protection, where offered, to ensure they cannot lose more than the funds in their trading account.

Another consideration is the cost structure. Brokers may charge spreads, which are the differences between the buy and sell prices, as well as overnight financing fees for positions held beyond a single trading session. These costs can add up over time and should be factored into a trader’s overall strategy.

Conclusion

Contracts for difference offer a flexible and accessible way for traders to engage with price movements across diverse financial markets. By allowing both long and short positions, leveraging capital, and providing exposure to a wide range of assets, CFDs have become a staple for many traders seeking dynamic opportunities. At the same time, these instruments carry inherent risks that require careful management and a disciplined approach.