Think about your physical wallet for a second. It holds your driver’s license, credit cards, maybe a library card. Each one is a piece of your identity, issued by some authority—a government, a bank, a local institution. You carry them. You control, more or less, when and where you use them.

Now, what’s the digital equivalent for your business? Honestly, it’s a mess. Your identity is scattered across a dozen platforms: Google, Facebook, your bank’s portal, your email provider, that industry directory you forgot you signed up for. You don’t own it. You’re just renting fragments of it from big tech landlords.

What Exactly is a Sovereign Digital Identity?

Let’s cut through the jargon. A sovereign digital identity is simply the idea that you—the entrepreneur—should own and control your business’s digital self. Completely. It’s not a profile on a social network. It’s a verifiable, portable, and secure collection of credentials that you manage.

Imagine it as a digital vault you hold the key to. Inside, you store verified proof of your business registration, professional licenses, tax status, customer reviews, even your reputation for paying invoices on time. When you need to apply for a loan, join a new B2B marketplace, or verify yourself to a client, you share only what’s necessary directly from your vault. No middleman. No unnecessary data harvest.

The Real Pain Points It Solves (This Isn’t Just Theory)

Why should you care? Well, because the current system is breaking your back with friction. Here’s the deal:

- The Onboarding Nightmare: Every time you sign up for a new wholesale account, payment processor, or government grant, you re-enter the same 25 data points. It’s tedious, error-prone, and frankly, a waste of your precious time.

- Fraud and Trust Deficits: How do new clients know you’re legitimate? A slick website isn’t enough. A sovereign identity lets you instantly prove your business is registered, licensed, and in good standing.

- Data Breach Vulnerability: Your sensitive info is sitting in dozens of databases you can’t even name. Each one is a potential target. Centralized storage is, to put it bluntly, a massive risk.

- Platform Lock-in: Your business reputation is trapped on platforms like Yelp or Amazon. What if you want to move or sell on a different channel? You start from zero. That’s a huge barrier for small business growth.

The Building Blocks: How It Actually Works

This isn’t magic. It’s built on emerging tech, but the concepts are pretty straightforward. The core idea is decentralization. Instead of one company holding your data, it’s secured on a distributed ledger (think blockchain, but don’t get hung up on the crypto association).

Here’s a simple breakdown of the process:

- Issuance: A trusted entity (a bank, government agency, certification body) issues you a digital credential. It’s like them giving you a digital, tamper-proof badge.

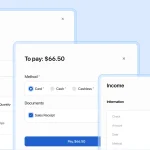

- Storage: You store this badge in your personal digital wallet (an app on your phone). It’s yours now.

- Verification: When needed, you present the badge. The verifier can check its authenticity against the issuer’s public record—without contacting the issuer directly or seeing any of your other data. It’s fast and privacy-preserving.

Key Technologies in Plain English

| Technology | What It Does | The Analogy |

| Decentralized Identifiers (DIDs) | A unique identifier you create, not a platform (no more @BigTechUsername). | Your personal phone number, not your employer’s desk phone. |

| Verifiable Credentials (VCs) | The digital, cryptographically-secured versions of paper certificates. | A digital passport with unforgeable stamps, instead of a paper one. |

| Digital Wallets | The app on your device where you hold and manage your VCs. | Your physical wallet, but for digital proofs. |

Getting Started: Practical Steps for Entrepreneurs

Okay, this all sounds futuristic. But you can lay the groundwork today. Sovereign identity is coming—through initiatives like the EU’s Digital Identity Wallet and various open standards. Getting ahead means building with that future in mind.

- Audit Your Digital Footprint: List everywhere your business has a login or profile. Start consolidating and cleaning up. Know what’s out there.

- Prioritize Verifiable Data: Seek out credentials you can get in a digital format. Some banks now offer digital proof of account ownership. Can your accountant provide a digital tax status letter?

- Demand Better from Service Providers: When signing up for new software or platforms, ask if they support secure, portable login methods like decentralized identity protocols. It signals the market is shifting.

- Educate Yourself on Standards: Keep terms like “W3C Verifiable Credentials” and “SSI” (Self-Sovereign Identity) on your radar. You don’t need to be an expert, but awareness is power.

The Bigger Picture: Why This Changes Everything

This is more than a tech upgrade. It’s a shift in power dynamics. With a sovereign digital identity, a solo founder in a rural town can have the same instant, verifiable credibility as a Fortune 500 company when applying for a tender. It levels the playing field in an incredible way.

It enables new, trust-based economies. Imagine a freelance platform where your skills, past project successes, and client ratings are portable credentials you own. You could move between platforms seamlessly, your reputation intact. That’s true digital freedom for entrepreneurs.

That said, the path isn’t without bumps. Adoption is fragmented. User experience needs to get smoother. And, you know, there’s the eternal question of digital literacy. But the direction of travel is clear: the internet is moving from an era of platform-controlled profiles to one of user-controlled credentials.

A Final Thought

Building a business is an act of sovereignty. You create something independent, valuable, and yours. Shouldn’t your business’s digital presence reflect that same principle? The tools to reclaim your digital self are being forged. The question isn’t really if you’ll use them, but when you’ll start asking for them.